Income generation in the crypto space goes way beyond trading. Let us show you the various ways to earn passive income in the crypto space.

When we speak about cryptocurrencies, what usually comes first to mind is the rapid rise and fall of crypto prices and how the right timing and strategy in trading could generate tremendous profits.

However, what if we told you that trading isn’t the only way to earn crypto? The advancement of new technologies and innovations in blockchain allows you to earn passive income in crypto. You can actually earn crypto whilst you sleep.

In this post, we show you four of the most common ways to earn passive crypto income. If you think active trading is not for you, then learning more about additional avenues of earning crypto income may be just what you’re looking for!

Earn passive income in crypto through lending

If you’re more of a crypto HODL’er and you don’t have any plans to use your tokens in the near future, crypto lending services provide a way to earn passive income while keeping your tokens. There are many services that offer this, including Binance Lending. There are also various kinds of crypto lending products that cater to your lending preferences. You can pick flexible deposits where there’s an expected annual return and you have the option to withdraw or deposit into these anytime. Alternatively, you can pick fixed deposits, where the interest rates can be higher, but you have to retain the funds for a set period of time, like a time deposit.

Where does the interest come from when lending crypto?

Some crypto services allocate the funds they collect into third-party products, services, and activities that are expected to yield earnings that will be shared back to lenders. Other crypto lending services, like Binance Lending, keep the funds in-house, instead of pairing the money with interest-yielding services such as Binance Margin Trading.

Mining tokens for more crypto

The earliest form of earning passive income in crypto is ‘mining’, a process wherein a blockchain network rewards you with tokens for doing your part in completing the computational work needed to confirm transactions on that network.

Simply put, you maintain a computing device (most usually referred to as a mining rig), connect it to a blockchain network (let’s use Bitcoin for this example), and let your device do what it does (cryptographic/mathematical problem solving that uses significant computing power). At the end of a hard day’s work by your computer you get rewarded with additional Bitcoin (or the tokens of your blockchain of choice).

Passive income through staking

There are many crypto tokens that allow you to increase your crypto holdings just by HODLing your tokens in a crypto wallet or platform that supports staking. Many of the major blockchain projects in the crypto world mint additional tokens through the process called Proof of Stake consensus. It’s similar to mining (Proof of Work), except instead of owning a computing machine with all its equipment, maintenance, and electrical costs, you just have to hold a certain amount of crypto to benefit from the minting process.

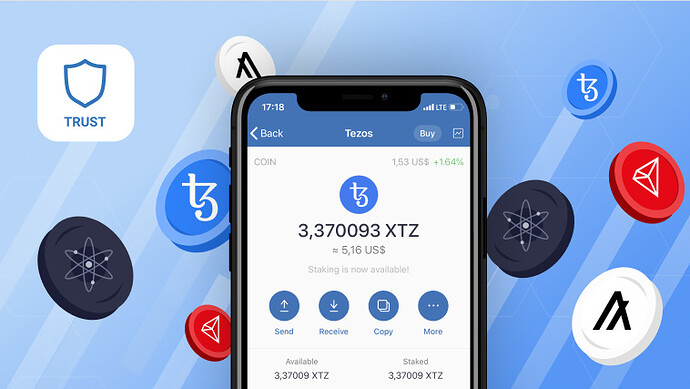

Trust Wallet supports staking for at least eight cryptocurrencies. This means that by keeping a staking supported cryptocurrency with Trust Wallet, you will can earn staking rewards for that crypto.

Maintaining masternodes: Another avenue for crypto passive income

Maintaining masternodes is basically crypto staking on steroids: you hold a significant volume of crypto, big enough for you to take charge of what’s known as a masternode. When you keep a masternode, you maintain a full node that keeps a copy of real-time blockchain records. You have to keep this masternode connected to other masternodes. Because of this, the crypto you hold in this node will have to stay there.

As a reward for the contribution to the blockchain ecosystem, masternode holders will get larger staking rewards. This compensates the masternode owners for the effort it takes to hold the large amount of crypto and keep the node connected.

Regardless of the method you choose to earn passive income in crypto, we always have a caveat emptor for these things. As crypto prices fluctuate frequently, it’s important to remember that earnings are not guaranteed and that you should do more in-depth research on any method for crypto passive income before deciding to pursue one track.

To get an idea as to how much you can earn passively in crypto, explore our staking calculator today!