The main discussion of this article is about the advantages and disadvantages of decentralized finance (DeFi for short)

Before discussing the advantages and disadvantages of DeFi, let’s take a look at the history of finance and how we felt the need to create a system that is not based on intermediaries. Finance has come a long way and reviewing this short history will help us better understand why we do prefer to add the concept of “Decentralized” to “Finance”.

At the beginning of human history, finance made no sense. Human needs were summed up in hunting for survival and finding shelters. Simultaneously with the increase in population, humans felt the need to interact with each other. Trading was an important part of this interaction.

The most basic form of trading was the trading of goods for goods. You had more meat than you needed, so you had to exchange the extra amount with the neighboring wheat. But to what ratio should this exchange take place?1:1 or 2:1. there was no clear criterion for determining the value of goods. Another problem with this method of trading was that you may not be able to find someone who is willing to exchange his own product with yours or it may take a long time.

with the expansion of goods and products, the need for a criterion and index for the valuation of goods was strongly felt. That’s how money was invented and the basic generation of finance emerged.The first money appeared in the form of coins, was made of electrum (an alloy of gold and silver) around 600 B.C.

read more about the history of finance

Now people could easily exchange their goods for money and vice versa.With the advent of industry, different types of money and assets became popular.The next generation of finance emerged with the advent of banks and third party applications to facilitate human life.

But hold on! Were all the problems solved?

who are controlling money? people or governments?

Is the distribution of money fair and equitable?

Is all the money spending on the welfare of the people and solving their problems?

Is money transaction safe despite intermediaries?

As you may have guessed when money is under the control of a particular entity (like government), we meet a big problem : “Irregular Printing of Money”

as you know, printing more money make goods more expensive, but does not change the quantity or quality of goods. True you have more money, but if everything is more expensive, you are not any better off. The value of gold is due to its rarity.

Governments took the right to print money and introduced themselves as intermediaries between two parties of trade through the central banks.

As a result, banks became intermediaries in all financial matters. Now everything depends on their management. But if money depreciation happen, due to mismanagement, who is responsible?

Money depreciation is a fall in the value of the money.

Easy monetary policy and high inflation are two of the leading causes of money depreciation.

We are not going to accuse a particular organization or group however, due to negligence of duty or maladministration of the central banks and intermediaries who were controlling the money, the world experienced financial crises. Factories and companies went bankrupt and many people were fired.

refer to the following links to read more about the financial crises :

Argentine great depression (1998–2002)

Global financial crisis (2007–2008)

Russian financial crisis (2014–2017)

Financial crises have caused people to lose confidence in traditional financial systems. People needed an unmediated financial system. Invention of Bitcoin was the first step towards achieving this goal.

With the advent of bitcoin and crypto currencies, finance had entered a new phase. Now the finance had changed dramatically, however, it still cannot be considered as a decentralized finance. Most of the crypto financial transactions and services are done through centralized exchanges.

What’s the difference between a bank and a centralized crypto exchange? Decentralization loses its meaning By adding an intermediary unit to a decentralized finance system.

Anyway, let’s say we have a completely decentralized financial system (DeFi).Could this system meet all our needs?

DeFi is a fast-growing sector of the cryptocurrency industry, consists of thousands of projects on blockchain, that all traditional financial services and even more, can be done through it, but without the interference of a third party like Banks or any other non-banking financial institutions. This is the next generation financing.

Eliminating intermediaries is the most prominent feature of DeFi.

Many believe DeFi is the future of finance and that investing in DeFi could lead to massive gains.

But is this investment risk-free?

Since it’s difficult for newcomers to separate the good aspects of DeFi from the bad, It would be useful to discuss the pros and cons of DeFi.

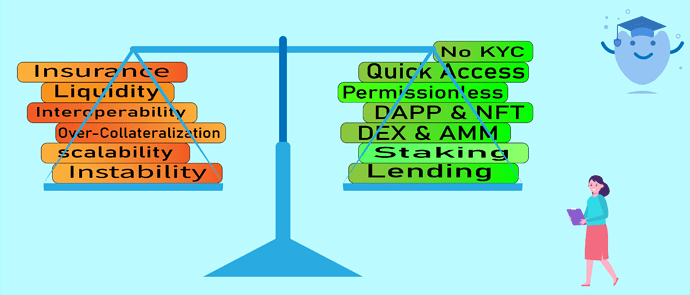

What services could be done through DeFi? (Advantages)

As mentioned above, all traditional financial services, such as lending services, various investing services, real state services, insurance services and non-traditional services like lending, decentralized exchanges (DEXs) and automated market maker (AMM for short),crypto collectibles (NFTs) and etc could be provided in DeFi space.

1)Decentralized exchanges (DEX):

an online service based on smart contracts.DEXes enable users to perform token exchanging without intermediaries.

What Is a Decentralized Exchange (DEX)?

2)Automated Market Maker (AMM):

AMMs are the same as DEXes with an important difference.A DEX platform uses an order book (which contains P2P orders) to pricing, while an AMM platform uses a special mathematical formula to pricing assets.

What Is an Automated Market Maker (AMM)?

3) Lending:

The crypto loan business is definitely an attractive alternative for many people. Lenders receive interest payments while borrowers gain access to capital.

The Ultimate Guide to Earning Crypto with Binance Lending

4) Staking:

some blockchains are based on proof-of-work (PoW) like Bitcoin and some other are based on proof of stake(PoS). staking is a type of activity in which you are rewarded by locking your assets in a PoS based network, to provide the security and transactions confirmation of a blockchain network.

What Is Staking?

5) Non-Fungible Token (NFT):

NFT is a new and marvelous phenomenon in crypto space which has many uses like identification, arts(digital ownership),gaming,collectibles, sports, media & entertainments,real estate, etc.

what is NFT?

6) No-Loss Games and Lotteries:

Games and lotteries are another attractive services that newly have entered in DeFi space. Some lotteries (called no-loss lottery) seems to be risk-free.in this type of lotteries participants get their money back and one lucky participant wins all the profit that has accrued in the shared pot and all these processes are done without intermediaries, just using smart contracts in DeFi space.

7) Bye-Bye to human errors and mismanagements:

We have already mentioned that financial crises occurred due to the mismanagement of central banks(CBs) and third party intermediaries(TPIs).But thanks to artificial intelligence (AI), errors do not occur in decentralized applications and they’ll act as planned.

8) Quick and permanent access :

If you need to get a loan,you have to go to bank and a lot of time will be wasted. While in DeFi space, you can get a loan with just one click even in the middle of the night. You can access the market from anywhere and anytime as long as you have internet.

9) Higher level of health :

Covid-19 has shown that traditional financial systems (CeFi) are very vulnerable to financial shocks.This is because centralized financial systems are based on direct contact between individuals.

COVID-19 has caused an economic shock three times worse than the 2008 financial crisis. economist Nariman Behravesh

The level of physical contacts in decentralized financial systems (DeFi) could drop to zero, thanks to the internet and softwarization.

10) Permissionless Operations:

In a traditional financial system, you have to get permission from an intermediary to carry out any financial operation. To withdraw a penny from your account, you must wait for bank approval, while DeFi users can interact with financial services permissionless and without KYC and identification.

A very wide range of services could be imagined in DeFi sapce, that not all of them could be mentioned in this discussion, like yield farming,liquidity mining, alternative savings dapps, derivatives, insurance platforms, asset tokenization platforms, kyc & identity services, marketplaces, placing bet and prediction platforms, data analytics & visualization platforms, risk managing programs, etc.

But are all of these services and platforms risk-free?

Undoubtedly, the answer is “No”. Just like an apple that may contain a worm, a DeFi product may have it’s own problems and risks.

What are the challenges facing DeFi projects?(Disadvantages)

Many of the problems and risks facing a DeFi project are related to it’s host blockchain.

since over 90% of DeFi projects are based on Ethereum blockchain, we could consider ethereum challenges as DeFi challenges.

Some of these problems:

1) Instability:

If the blockchain that hosts a DeFi project is unstable, the project spontaneously inherits this instability from the host blockchain. The Ethereum blockchain is still undergoing plenty of changes, for example moving from the PoW to the PoS system.

2) scalability:

Another big problem with DeFi projects is scalability of the host blockchain. Two major problems arise from the scalability problem :

transactions take a long time to be confirmed.

paying high gas fees for every transaction and operation.

Ethereum at full capacity, can process about 13 transactions per second, while centralized counterparts can process transactions much more efficiently.

3) Smart contract problems:

smart contract vulnerability is a major source of issues for many DeFi projects. If there is the slightest flaw in the code of a smart contract, it can lead to loss of funds.

4) low liquidity:

Liquidity can be considered as one of the most important factors for DeFi token-based projects and blockchain protocols. The total value locked in DeFi is over $12.5 billion by october 2020,however it still cannot compete with the centralized alternatives.

5) Over-collateralization:

As we previuosly said the crypto loan business is an attractive service in DeFi. But this business suffers from over-collateralization and it occurs when the value of the staked asset(by borrower) is more than loan amount.

6) Low Interoperability :

There are different types of blockchains such as Bitcoin, Ethereum, EOS, … each with its own DeFi ecosystem and community. interoperability enables DeFi platforms, tools, dapps and smart contracts on different blockchains to interact with each other.

7) Lack of Insurance :

it protects investors in the event of a hacks or other fraudulent activities. Insurance plays a very important role in centralized finance while It has been neglected in decentralized finance (DeFi).

8) Centralization:

Creating a decentralized finance is the main purpose of creating bitcoin and blockchain, but sometimes decentralized finance isn’t as decentralized as it should be. Decentralization greatly reduces the possibility of scam.“Sushiswap” was a DeFi project.The anonymous founder of Sushiswap has exit scammed after converting all of his sushi tokens to ETH on September 5, 2020.The price of SUSHI token went up in value to $10 after forked from the Uniswap protocol, and dropped to 0.6$(at the time of writing this article) after founder converted his tokens. this was an example on how centralization could cause a good DeFi project to deterioration.

9) Responsibility:

Assuming that DeFi is free of risks and issues, it’s still not responsible for your mistakes. DeFi transfers responsibility from intermediaries to users. If you lose your funds by mistake no one will be responsible, hence, creating some tools to prevent human errors and mistakes is strongly felt in DeFi space.

DeFi is new and experimental and has some issues and problems, especially in terms of security. Developers and fans of decentralized finance hope that these problems will eventually be solved.

This article does not contain investment advice or recommendations. Before investing ,weigh the pros and cons.