Hello community,

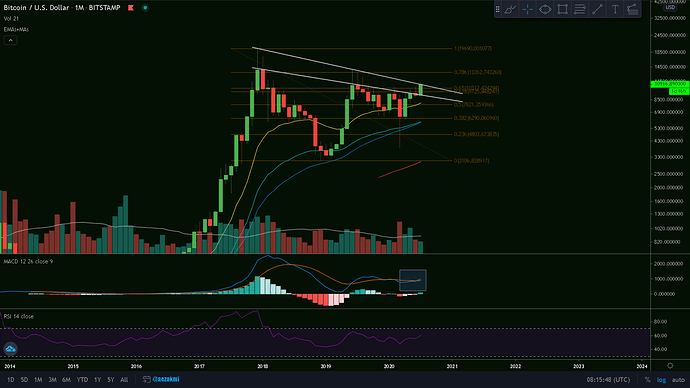

With the recent 20% rally, Bitcoin has jumped from the descending body-to-body trend line directly to the descending wick-to-wick trend line! We are currently right at the upper trend line and the bulls are fighting to close the monthly candle above it (~$10900). Closing a candle above both the descending trend lines could be the beginning of a new bullish cycle, if not, it could be a very nice short opportunity.

Here’s the BTC/USD Monthly Chart:

What’s your opinion? Do we get to see new local highs and break the $12000 level or is it just another rejection?

Thanks,

Aezakmi.

6 Likes

I think we should seat back and watch as we emback on a roller coaster ride because we are astonomers heading to the moon… before the end of 2020 there are speculation that btc will hit $20,000 and technically it seems possible.

2 Likes

And you might be just right!

Soon will break 12000$ mark then there’s no coming back

2 Likes

Honestly IMO all the recent rally is because of the fed mint fresh money to jumpstart the economy that stuck because of this COVID situation. Hope all govs from all of the countries are prepared so there wont be any second wave or else the price will plunged again.

Judging from the chart 18-19k is 2017 resist. Hope we could reach them in the next Q3 or early Q4.

2 Likes

I refuse to believe BTC is done yet. Wait for it!

2 Likes

I really don’t know what caused this pump; perhaps the people got bored of the bear market and lost their patience. Or they are just staying at home because of the virus thing and everybody is scrolling the internet looking for new opportunities  . Who knows?

. Who knows?

All I know is that traditionally a bear cycle lasts about 400 days and breaking the previous All-Time-High lasts around 1000 days. And we’re at ~940 days since our 2017 ATH. So yes, 18-19k in Q3-Q4 is definitely doable.

2 Likes

. Who knows?

. Who knows?