As we make our way into 2020, one blockchain topic has taken clear precedence over all of the others. Decentralized finance is at the forefront of everyone’s minds as the digital asset industry shifts away from speculation towards mainstream adoption.

But What Is Decentralized Finance?

Decentralized finance, or DeFi for short, is composed of financial applications that operate through a decentralized blockchain. They effectively cut out the middle man that many of the finance-focused apps and platforms we use today employ.

Hearing this explanation, though, you may be wondering what’s so innovative about DeFi. Cryptocurrencies, such as bitcoin, have been around for years, providing us with a decentralized financial system. However, cryptocurrencies represent just one aspect of DeFi – the intermediary of exchange.

Today it is still difficult to perform many financial actions, such as taking out a loan, without going through a centralized intermediary. Bitcoin and other cryptocurrencies don’t cover that use-case.

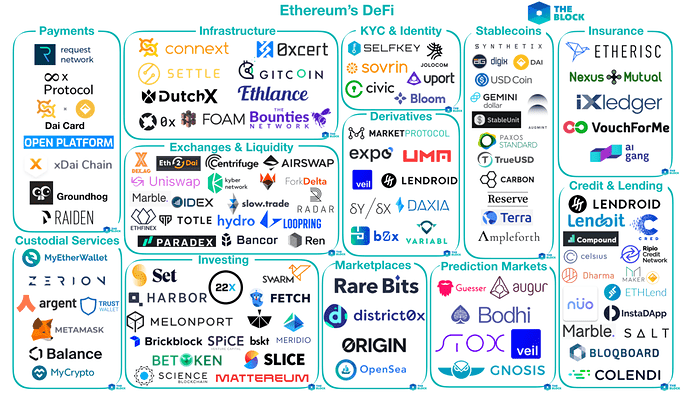

DeFi aims to expand the value that cryptocurrency has brought over the past few years to the entire financial sector, including:

Borrowing and lending,

Stocks, bonds, and other tradable assets,

Insurance,

Asset storage,

And several more areas, as well.

DeFi vs. Centralized Finance

To gain a better understanding of the impact DeFi can have on the economic landscape, it’s critical to outline how it improves upon our current centralized infrastructure, as well as cover the areas in which it falls short.

The Advantages of DeFi

Decentralized finance benefits from many of the characteristics that blockchain technology possesses. These benefits include:

Autonomy – The money and assets that you own in a DeFi ecosystem are yours and yours alone. There is no centralized authority, such as a bank, with the ability to freeze your account, seize your assets, or block your transactions.

Accessibility – If you’ve been active in the digital assets industry for some time, you’ve likely heard about the 1.7 billion unbanked people around the world. Unable to access bank accounts, these people are at a disadvantage to pursue many financial opportunities.

Unfortunately, centralized financial institutions don’t have an incentive to target this population. The revenue they would receive from providing services to the currently unbanked simply doesn’t justify the costs of reaching them. Because DeFi apps operate without expensive intermediaries, they can afford to reach those people.

Tradability – Synthetic assets, aka tokenized assets, are another aspect of DeFi bringing immense value. By creating tradeable tokens that represent, say, a portion of a real estate investment, you open up the investment for people who previously couldn’t afford it, to potentially having access from anywhere in the world.

Similarly, DeFi enables investors to trade more efficiently becuase they aren’t required to commit to an entire high-value investment at once. Instead, they have the option to buy or sell just a portion.

Transparency – DeFi data is publicly available, enabling you to keep service providers honest. For instance, you can easily check the reserves of a DeFi bank, shop around for accurate loan rates, or even track the transactions of public figures.

The Disadvantages of DeFi

DeFi does have a significant number of benefits, but it’s not without its faults.

Giving individuals complete control of their money and assets is risky. Lost private keys, forgotten passwords, mistyped addresses – the list of ways you can lose your cryptocurrency goes on and on.

According to the Wall Street Journal, over one-fifth of all bitcoin are currently missing. With further adoption, we can expect this figure to grow.

Additionally, the complexity of smart contracts opens the potential for attack vectors that don’t exist in traditional financial systems. Looking through history, you can find a nearly endless number of examples that demonstrate how less-than-stellar smart contracts have led to a host of people losing their cryptocurrency. (Remember the DAO attack?)

Finally, the DeFi regulatory landscape is still ambiguous at best. Although many government entities are making headway, much of the law and DeFi classifications are still uncertain. Therefore, most businesses are hesitant to jump in fully.

The 2020 Outlook for Decentralized Finance

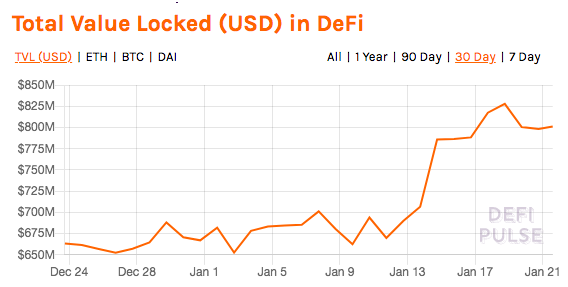

Overall, the pros of DeFi outweigh the cons significantly. And already, DeFi looks poised to continue its momentum from 2019. In January alone, the amount of money locked in DeFi apps grew around 20 percent.

Currently, lending and borrowing platforms comprise the majority of the DeFi space. In fact, five of the top ten most utilized DeFi apps are lending providers. However, this year, we should see an increase in other types of DeFi apps, as well.

Most notably, several institutions are working on digital asset management platforms, enabling customers to participate in the DeFi landscape without the responsibility (and risk) of holding their own assets. And we’re not talking about crypto-exclusive businesses, either. ING, Fidelity, and J.P. Morgan are all working on, or have already launched, some form of a digital asset custody solution.

As we move forward through the year, we’ll continue to see a melding of the old and new worlds of finance. Traditional institutions will further dip their toes into the digital asset space. And DeFi companies will chip away at new financial areas.

Fortunately, they’re two sides of the same coin, both sides providing us with the decentralized future that we all deserve.

Source: elev8con

1st image source: The Block

2nd image source: DeFi Pulse