Cryptocurrency exchanges, centralized or decentralized?

Introduction

In this current day and age, cryptocurrencies has been slowly getting media attention. Primarily Bitcoin or BTC gets the spotlight. It was created 10 years ago and is still being traded right now on exchanges and being used in one form or another. It is a new type of digital currency that are secure and can be transmitted anywhere. No need for forms or to wait in line just to send Bitcoin to anyone. You can just do it simply on your computer or on your mobile phone.

If you are surprised to hear about it just now, then what if I told you that there is about at least 2,000 different types of cryptocurrencies out there. This is possible due to distributed ledger technology, which is basically a fancy way of saying an auditable database of transactions. But I won’t go deeper on that. I will be explaining on how to simply buy and sell crypto.

The first thing that comes into mind, where do I get them? Nowadays, you can exchange your fiat to crypto in so many ways. It can be peer to peer, thru a kiosk selling crypto or through exchanges.

Wait, what is fiat? Fiat is what the crypto space calls your paper money, or local currency. The word “fiat” is Latin in origin and refers to an arbitrary order issued by a government or other authoritative figure. When applied to paper money, fiat currency refers to the scary notion that our dollar has value only because the government says it does.

Source: Google.

Going back to our topic, cryptocurrency exchanges. There are actually two types, a centralized and a decentralized one.

Centralized Exchanges

By definition of centralized, it is to concentrate by placing power and authority in a center or central organization.

In the crypto space, there are several centralized exchanges that you can choose from. They almost have the same onboarding process as any other exchange. Some offer basic trading that allows you to buy and sell any crypto that they currently have listed. There are also options for the advanced traders who are into margin trading and futures contracts.

Creating an account will require signing up with your personal email. But, in order to fully utilize the features of the exchanges, and most importantly the withdrawal limits, you have to pass KYC. Know your customer, alternatively known as know your client or simply KYC, is the process of a business verifying the identity of its clients and assessing their suitability, along with the potential risks of illegal intentions towards the business relationship.

Since we are dealing with fiat, which is basically money, you need to submit yourself to these screenings to prove your identity. This is due to regulations set in place by the government over these exchanges. And also to prevent money laundering and other nasty stuff.

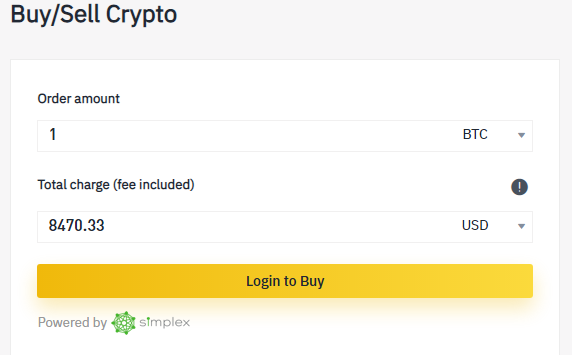

After going through the initial steps and your identity has been completely verified, you can then proceed in buying some crypto. Using that old credit card, you will have options to buy Bitcoin or any other type of currency that the exchange has to offer. Usually, the interface if pretty self explanatory, choose the crypto that you want and an equivalent price in fiat will be specified. The computation includes the current conversion rate of the crypto, plus the fees in completing the transaction.

How a fiat onramp looks like:

You will have the funds deposited on your account that you have just created on the exchange. Depending on the crypto that you have purchased, they will have their own corresponding wallet. A wallet is what holds your cryptocurrencies. Think of it as just a regular wallet, your crypto stays there for the meantime and just waiting for you to make a trade.

Now for the fun part, you can trade it on the exchange for any currency that your heart desires. Just keep in mind that a certain fee will be paid in every transaction that you make on the exchange. A certain percentage is applied when creating a buy or sell order. You can either trade it for something else or just hold the one that you want, expecting an appraisal in value in the long run. At this point, I will leave it up to you to decide. As much as I want to recommend some crypto, I do not provide financial advice.

These exchanges handle and store your funds. As long as you keep your login credentials secure and setup a 2FA (Two-Factor Authentication) then you are a step ahead in keeping your funds safe. However, centralized exchanges are a constant target of hackers as they hold a large amount of crypto. If an exchange gets compromised and they manage to take out or withdraw the funds, you technically have no way to retrieve them anymore, unless the exchange has some form of insurance.

The convenience of having your funds stored on the exchange is one of the main factors why more people tend to use them. Having a chance to make an immediate trade to gain a quick profit is one of the benefits. However, for others who prefers hanging on to their own crypto, then there is an option for you.

Decentralized Exchanges (DEX)

Let me thank you for still continuing to read up to this point. Now you have come to the best part. If you thought buying crypto was easy then try to challenge yourself a bit with the decentralized version. Decentralization is the process by which the activities of an organization, particularly those regarding planning and decision making, are distributed or delegated away from a central, authoritative location or group.

The second most traded crypto currency is called Ethereum or ETH. This differs a bit from Bitcoin since it has a smart contract or scripting functionality. This smart contract has enabled the creation of decentralized exchanges that allows anyone who interacts with the code to make a trade with everyone on the same network. This method has been widely used by those who are a bit more technically inclined.

So who has authority over these decentralized exchanges? Anyone can freely use it as long as the rules are being met. In the crypto space, rules are set by mathematical computations or codes. As what I said earlier, this is for the more tech savvy of sorts and not for the faint of heart.

Moving on, you will still need to have some crypto in order to make trades on a decentralized exchange. You can either buy them from centralized exchanges, as this is the simplest way to do it. Centralized exchanges allow you to deposit your crypto on their platform. However, you can always withdraw them to your own wallet for safe keeping. Why? Because not your keys not your crypto. At this point, you will have full control over your funds by using a private key. Just make sure you keep these keys to yourself then you should be all good.

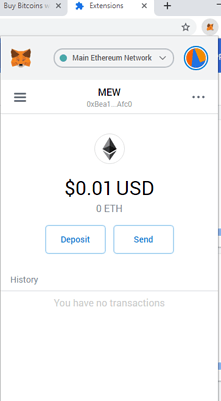

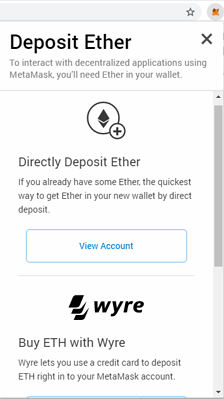

Here is one example of an Ethereum wallet which is Metamask. It is an extension of your web browser, or basically a plugin that resides on your computer. Still with me? The terms are a bit confusing at first but if you get to see it more often and read about it, you will eventually get to know them.

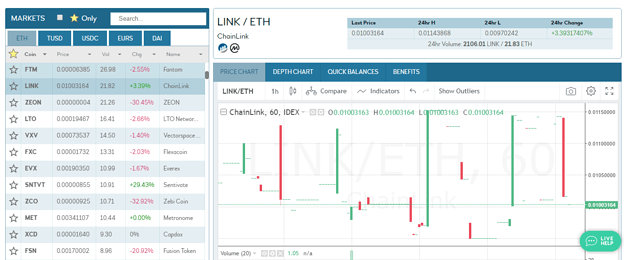

Now why would I then trade on decentralized exchanges? For me, it is a matter of preference and I feel more secure doing trades directly from my wallet. The funds are on my wallet and I just interact with a site to perform a trade. Here is an example of a Decentralized exchange.

You can put a buy or sell order directly on the exchange, and once the trade completes, funds are still in your wallet. No middle men, just paid some fees to make the trade and your done.

Everything happens on the background and completed in a matter of seconds. Pretty straight forward right? Well, as long as you know what you are doing then you should be fine.

Security is one of the best factors a decentralized exchange will offer. However, it has a much lower number of available crypto to choose from. Remember I mentioned that there will be rules, and not all cryptocurrencies will have the same rules. For this example, any tokens that are issued in the Ethereum network can be freely traded on this exchange. And thus low liquidity is to be expected and trading volumes might be considerably lower than a centralized one.

What type of exchange should I use?

Here are some key points about Centralized and Decentralized exchanges.

| Key Point | Centralized | Decentralized |

|---|---|---|

| Control of Funds | Exchange | User |

| Usability | Easy | Medium to Hard |

| KYC | Yes | No |

| Downtime | Yes | No |

| Liquidity | High | Low |

| Feature Rich | Yes | No |

As seen on the table above, both exchanges have their pros and cons. You cannot really go wrong on whatever route you take.

The realm of cryptocurrencies can be a bit daunting to a person who is not that quite well versed in the terminology and the aspect of trading. However, we are free to decide on whatever platform we decide to use based on our comfort level. Anything that involves money has its risk, this it the only thing I am certain.

Always do your own research and take time to familiarize yourself before you step in.

Trading Simplified

In closing, anyone can start their crypto journey in a matter of minutes. If you are a long term investor or would just like to make a quick trade, there will be a lot of options available for you now. 10 years ago, you can only trade Bitcoin and it is not an easy task then too. The current state of the crypto space is extremely fast paced and in continuous development. Anyone who has access to the internet can get onboarded and crypto has more user cases now. Newer technologies are being created to allow a more simpler approach to trading. Right now you can even trade directly from your mobile phone, all the while keeping your funds safe on the same mobile wallet.

Stay safe everyone and support the projects that you think will make a big impact on the future of the crypto space.