For people looking to invest and maximise their holdings in cryptocurrencies, it is imperative to be aware of DecentralisedFinance (DeFi), Decentralised Applications (dApps) and Collectibles, and to know how to maximise their holdings in DeFi.

In this guide, we explain what DeFi, dApps and Collectibles are, how to find out which dApps and DeFi products are safe for investment and how to maximise DeFi holdings.

What is Decentralised Finance?

Decentralised Finance (DeFi) refers to the ecosystem of financial apps and products built on top of and leveraging blockchain networks. There are no intermediaries or arbitrators like financial institutions, all disputes are handled by the software code. Costs of entry are also significantly less when compared with traditional finance and low-income individuals can also partake in available DeFi products and services.

An example of a DeFi project is the Compound protocol whereby users lend and borrow funds. Lenders supply assets to the liquidity pool from where borrowers may borrow assets, with lenders earning interest every 15 seconds.

Something very interesting about DeFi is how it enables people to enter the world of finance without having to go through extensive paperwork and hassle given the over-legislation of the financial world. Consider the example of Chile where in order to make opening bank accounts easy for the masses, the state bank of Chile, BancoEstado, launched the CurentaRUT service which allowed users to open a bank account without any opening or maintenance fees. However, people still had to visit a bank branch and so adoption remained low in many areas despite there being good smartphone penetration.

This shows that people want to use financial products/ services but they do not want to be inconvenienced with visiting branches or filling out paperwork. DeFi with its open and decentralised nature can allow such people access to financial services without ever having to resort to conventional finance.

What are Decentralised Applications (dApps) ?

Decentralised Applications (dApps) are programs that live and run on a decentralised and distributed network like Ethereum. An example of a dApp is Uniswap, which is a DeFi dApp that allows users to swap Ethereum based tokens in a decentralised-manner.

What are Collectibles and Non-Fungible Tokens?

Fungibility is the quality of any item to be mutually interchangable.

Investopedia defines it as “the ability of a good or asset to be interchanged with other individual goods or assets of the same type. Fungible assets simplify the exchange and trade processes, as fungibility implies equal value between the assets.”

Non-Fungibility thus refers to every item being different from the other and thus not interchangable. For instance, consider two paintings by Picasso, while they are both paintings, they are completely different from each other. In the context of blockchain tokens, Non-Fungible Tokens (NFTs) are special tokens which are not mutually interchangable and thus are unique.

It is interesting to note that NFTs can be made to represent real world assets like realty. The adoption of NFTs will definitely increase once governments also start leveraging blockchain technology and tokenisation.

How to maximise crypto-holdings in DeFi?

A lot of people have purchased cryptocurrency but do not know how they can maximise their crypto holdings. One way is via investing/ trading in the DeFi products on the Binance Smart Chain.

To explain this in detail, we will now consider an example.

Lets assume you want to earn by supplying your crypto holdings to a liquidity pool on Binance Smart Chain (BSC)’s leading decentralised trading protocol, PancakeSwap.

You will first have to download the TrustWallet app. Then, click on the four blocks icon to open the dApp browser.

The dApp browser lists the available dApps and segregates into helpful headings like DeFi, Games, Exchanges, Marketplace etc. This is so you can know what category a dApp belongs to and select one accordingly. Today, we will use a DeFi dApp built on the BSC called PancakeSwap.

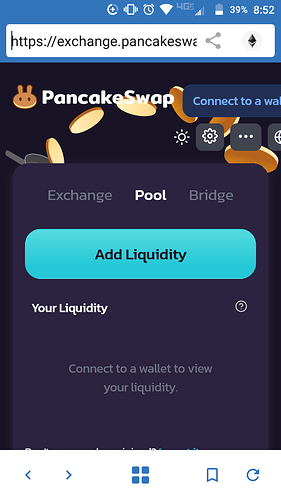

Find PancakeSwap in the dApp browser and tap on it. Alternatively, you can visit exchange.pancakeswap.finance.

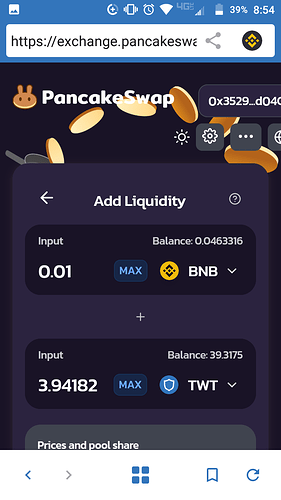

Tap “Pool” and select a crypto token pair. These would be the two crypoto tokens that you would be supplying as a pair to the liquidity pool. Next, tap “Add Liquidity”.

Input the amount of both tokens that you wish to supply. You will now see the prices of both tokens and your supplied tokens as a share of the entire pool.

Finally, tap Supply. After this, you will receive CAKE tokens in proportion to your contribution and you will receive a percentage of the transaction fees collected from users exchanging their tokens with those in the pool. This percentage is commensurate with your share of the pool.

Beware that staking assets in a pool is not without its problems.

You can also explore and invest in other DeFi apps listed on the TrustWallet dApp explorer such as Compound, which lets you lend your crypto holdings while earning interest.

In addition to this, TrustWallet also enables you to store crypto collectibles. These are collectible non-fungible digital assets (NFTs) which may be traded with other NFT’s or sold for a profit. This can be thought of like collecting rare paintings or artifacts.

Bottom Line

Letting crypto sit in a wallet is something that should be avoided. Instead, with the number of DeFi dApps maturing and increasing in number, one should explore and invest in a worthwhile project. However, finding safe and trustworthy dApps might prove to be a hassle. In this regard, TrustWallet helps you do it with ease and security using its block explorer.