Do you have a smart phone? Do you have internet? Then continue…

DeFi, DApps, and Collectibles… does all this mean nothing to you? If no read more you will discover new opportunities to maximize your crypto holding. If yes, then comment to let people know about this awesome world.

Since the advent of bitcoin over ten years ago, the crypto world has never stopped evolving.

What is DeFi?

Picture: https://www.finivi.com/ethereum-defi-platforms

Also called Money Legos, DeFi or Decentralized Finance is a new type of financial system commonly built on the Ethereum blockchain. Being based on blockchain, it uses smart contracts to ensure transactions between users. With DeFi there is no more need of an intermediary like a bank, everything is between you and another peer (P2P) and all transactions are recorded in the blockchain, registered on what are called nodes. The traceability and transparency are guaranteed, you manage your own money and best of all your money will easily generate interest, if you know how to do it.

When talking about digital assets, many think they have no relation to traditional (FIAT) currencies. This is not always true, indeed, some digital assets are pegged to a Fiat currency. So you can therefore convert one to the other quite easily and make your transactions far from the volatility of the crypto market. They are called Stablecoins, some examples: Tether (USDT), USD Coin (USDC), True USD (TUSD) all pegged to the US Dollar. And it’s important to know that DAI was the first decentralized stablecoin.

What are DApps?

Also known as DEX (Decentralized Exchange), DApps or Decentralized Applications are the support of the Decentralized Finance. They are the plateform and interface between users and the blockchain, between you and your finances. They can be used to store, manage and transfert digital assets from a peer to another peer throw the blockchain.

To let you have an idea, some of the most known DApps: Maker, with more than $600 million of liquidity pool locked in, Synthetix with over $140 million or Uniswap with its $59,5 million. (source: https://www.finivi.com/ethereum-defi-platforms/)

That liquidity pool comes from the users, you and me. It is a pool of tokens locked into a smart contract that allows to facilitate trading on the DApp. Users who locked their assets into that pool are rewarded based on the amount of coins locked and the locking time.

What are Collectibles? ERC 721

Pictures: Understanding Blockchain-powered Non-Fungible Tokens (NFTs). | by Chimezie Chuta | Medium

To explain what collectibles (crypto-collectibles) are, also known as NFTs, let begin by what we already know. Let suppose that I am in need and I asked you to send me some Ethereum (0.5 ETH) to make a transaction urgently. I spent what you gave me but I bought some others 0.5 ETH and paid you back.

First question: What I gave you back is what you lent me… isn’t it?

Answer: yes if it was a fungible token like Ethereum. But NO, if it is a COLLECTIBLE.

Second question: Could I have borrowed a decimal number of the token from you?

Answer: yes if it was a fungible token like Ethereum but NO, if it is a COLLECTIBLE.

Indeed, a crypto-collectible or NFTs (Non Fungible Tokens) is a non-fungible digital asset. At the opposite of other cryptocurrencies for which all the tokens are identical, every token of a collectible is either unique or in a very small quantity. Bitcoin, Ethereum or Ripple for example are fungible tokens but others like Cryptokitties (created by Dapper Labs), Rarible are Non-Fungible Tokens.

The collectibles are often assimilated to everyday objects like pets or avatars; even the more playful can have fun giving a name to each of their tokens.

Here you can see some NFTs: NFT Tokens & Coins - Top 50 List | Coinranking

Now the important, how can i grow my crypto holdings thanks to the DeFi and DApps?

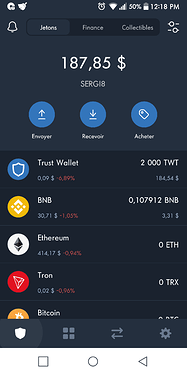

Before tackling this part, it should be remembered that you have to keep your cryptos in a decentralized wallet for which you have the private key. This is the very principle of decentralized finance systems. If your crypto assets are one a centralized wallet, you can download a decentralized wallet app like Trust, and transfert the assets into it to begin.

Today many platforms give us the possibility of lending or staking. For those who do not know what it is, these are ways to have passive income by locking for a time some crypto assets, by “lending” to the platform a given quantity of a cryptocurrency. This passive income depend of course on the locked quantity and the locking time. Although these platforms are quite secure for the most part, they are often centralized as example of Kucoin.

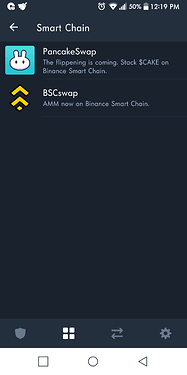

But today it is possible to earn passive income while keeping your crypto assets into your decentralized wallet. This is the advantage that gives us this type of system like the fully decentralized Binance Smart Chain (BSC).

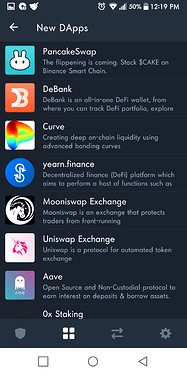

Let’s take a concrete example, you have crypto assets in your decentralized Trust wallet. You just have to go to the DApps option from your menu then you exchange your assets against the cryptocurrency whose stacking is proposed and all this thanks to the list of the many decentralized exchanges offered. You do not have to move to an extern exchange and come back, losing some big fees. After that you just have to choose the amount you want to put into the liquidity pool… then it’s done, you can now benefit from your passive income. And you can remove your assets whenever you want.

If you have any doubts about which DApp to trust, you have a trusted wallet to recommend them to you. Trust wallet offers you a wide range of DApps (PancakeSwap, DeBank, Curve, yearn.finance, Uniswap exchange …), which allow you to do your staking and exchange your assets in complete safety and thus to collect your passive income.

Pictures: screenshots from my personal Trust wallet

DeFi and DApps have given us a new vision of crypto holding. Let’s enjoy it with the good wallet…