I do staking for a while now but i still confused how to calculate my profit, it’s very helpful if someone can explain it, so i can research what coin/token should i stake and how much profit i get,thanks

Staking profits depends on the percentage of return a validator provides per annum a.k.a APR (Annual Percentage Rate). Suppose you want to stake 100 “A” coins to a validator that provides 10% APR. Then you will get 10% interest on your asset every year. Means after 1 year, your net asset will be 100+(100×10%)= 110. That means everyday you will get 10÷365= 0.027% interest or 10÷12= 0.833% interest per month.

By the way, you can also calculate using TrustWallet(dot)com/Earn

Thanks alot for this but am still a bit confuse because I do see some staking on Trust Wallet like Trx staking which APR 0.74% with 3 days lock time.

What does the 3 days lock time mean since the 0.74% is given in a year?

I thought maybe the APR 0.74% will be given after every 3 days lock time

Very easy. When the staking feature is provided by wallets or exchanges, it is usually told what a percentage of the profits are.

Percentages are usually given on a daily, monthly and annual basis.

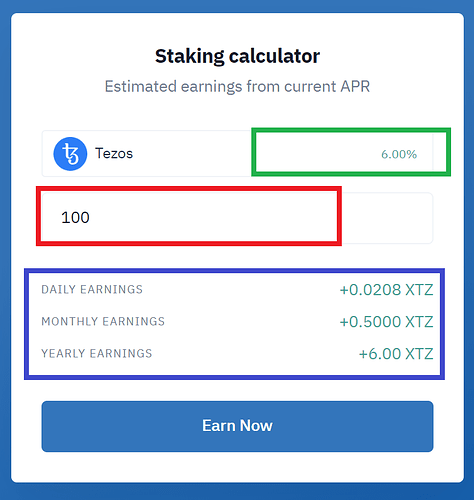

For Trust Wallet ![]() , the staking feature is provided with an easy to understand UI. Provided an annual percentage abbreviated as APR. There is also a live calculator, so just enter the number you want, the system will display how much income you get daily, monthly and yearly.

, the staking feature is provided with an easy to understand UI. Provided an annual percentage abbreviated as APR. There is also a live calculator, so just enter the number you want, the system will display how much income you get daily, monthly and yearly.

What if a calculator was not provided, and only a percentage? You can calculate it with the formula:

Amount to stake x Percentage

Example:

Staking the cosmos with 7%/year of 100

Then:

100 x 7% = 7 (Then you get 7 Cosmos profit for a year if you have 100 cosmos.

I hope this helps ![]()

![]()

![]()

Find also on google.

Exactly, the name express itself 0.74% APR (Annual Percentage Rate), so if you stake 100 TRX then after 1 year you will get 0.74 TRX as interest, and your net volume would be 100.74 TRX.

Now coming to Lock Time. There are two types of staking.

- Lock Staking: locked up staking is the mostly available staking program. This means locking your crypto assets in a proof-of-stake blockchain for a certain period of time. These locked assets are used to achieve consensus, which is required to secure the network and ensure the validity of every new transaction to be written to the blockchain. Those who stake their coins in a PoS blockchain are usually called “validators.” For locking their assets and providing services to the blockchain, validators are rewarded with new coins from the network. For example, In order to stake in Trust Wallet, you must accept minimum of 3 days locking period. Means, in these time, you can’t move or access to your balance. You can unstake after at least 3 days.

- Soft Staking : There’s no locking period. Most of the well known exchange supports this type of staking to support their user.

Thanks for the information, I never knew trust wallet has a staking calculator.

I suggest it should be embedded into the application as well.

Very helpful mate, thanks alot. Please I still want to know if I unstake my stake after the lock time and use my coin for something else will I still be given the incurred annual interest?

For instance, let’s say I stake 100trx for the lock time of 3 days with 0.74% APR. Then after the completed 3 days I unstake all 100trx and maybe use it in the exchange market, will I still be given my incurred interest daily until it reaches 0.74trx even if the Trx is no longer in my wallet or stake?

Am still a newbie in crypto

No, You will get interest as long as you have your assets staked in the validator. If you unstake after 3 days then you will get interest for 3 days only. If you stake for 100 days then you will get interest for 100 days.

Now I understand  , am fully satisfied now

, am fully satisfied now  . Thanks alot bro

. Thanks alot bro

Thanks a lot to the community member for the information, i understand now and will moving forward to the next target

Try this website to calculate your staking rewards:

stakingrewards*com/calculator

change * with .

Thank you sir for share this information

Please somebody help with this caculation if I stake 500tron how will be my profit per day or per week?

The APR % shown on the validators page differs from the actual % from said validator though. For example, Everstake for COSMOS is showing at 7.21% but if I go on their website, it shows 8.55%… why is there this discrepancy?

Specifically for Cosmos / Kava blockchain all APR information calculated based on the on chain data and it should, should be quite accurate.

Formula for APR calculation for cosmos is available here to review: https://github.com/trustwallet/blockatlas/blob/master/platform/cosmos/stake.go#L182