What is DeFi (Decentralized Finance)?

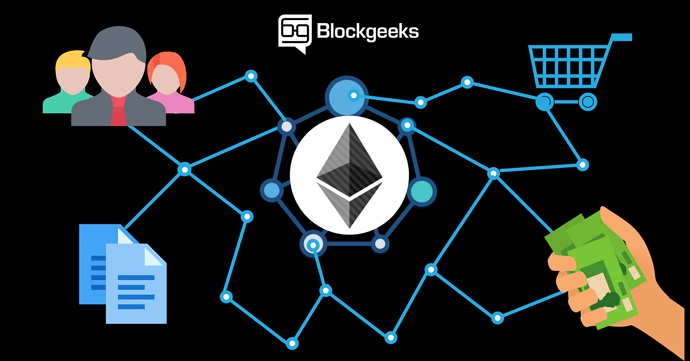

DeFi (Decentralized Finance) is an application that uses smart contracts, which run (generally) the Ethereum blockchain, to obtain loans in the form of crypto assets and as collateral for crypto assets. For example, you can pledge Ether (ETH) to get a loan in the form of DAI stablecoin worth US dollars.

Smart contracts are the most powerful feature on the Ethereum blockchain. Anyone can use it to create cool applications. The use of smart contracts in the DeFi sector has increased recently, which is reflected in the value of crypto assets stored in them.

Smart contracts are a special “programming language” on the blockchain. Programmers can take advantage of that code to create applications that run completely on the blockchain (decentralized).

The use of smart contracts guarantees minimal human intervention in the process. Users just need to be sure that the program code is running automatically.

The top three DeFi, is :

1.Compound (US $ 629.8 million)

2.Maker (US $ 557.9 million)

3.and Synthetic (US $ 319 million)

What is DApps (Decentralized Applications)?

DApps (Decentralized Applications) is a type of application that is currently being discussed, where this application is not owned by anyone, cannot be turned off, and the system cannot be down.

Sounds crazy, right?

This type of application is called DApps which is short for Decentralized Applications, decentralized applications.

- Open Source - Application source code must be accessible to everyone

- Decentralized- All application operation records must be kept in public and decentralized systems to avoid central control

3.Incentivized- The application has a cryptocurrency / token / digital asset to run on its own

4.Algorithm/Protocol- Generates tokens and has a consensus mechanism built into it

DApps classification

Based on the Blockchain model used, DApps can be classified as follows:

Type 1

This type of DApps has its own Blockchain system like Bitcoin. Other altcoins also fall into the type 1 DApps classification

Type 2

This type of DApps uses Blockchain Type 1 and is a protocol that uses tokens to function. An example is the Omni Protocol.

Type 3

This type of DApps uses the DApps type 2 protocol. An example is the SAFE network.

How Does a DApp Work?

DAppss work by implementing the four criteria above. This means that DApps is a software platform that is open-source and implemented on a decentralized Blockchain system, and runs using tokens generated using an algorithm / protocol.

How to start a DApp project?

Step 1: Create a Whitepaper

Step 2: Start the ICO Process

Step 3: Build and Develop Products

Step 4: Launch the Product

What are Digital Collectibles? Non-Fungible Tokens (NFTs)

If like a curious Alice you’ve gone down the rabbit hole researching the exciting world of digital collectibles, the chances are you’ve come across the acronym NFT or Non-Fungible Token. You may even have seen the more technical terms (ERC-721, ERC-1155), but more on them later.

Use this article to gain a high-level understanding of what this new technology is, what opportunities it opens up and how it will change the world as we know it.

NFT… Wait, what?

In the simplest terms, Non-Fungible Tokens (NFTs) are unique digital items whose ownership and any transfer of ownership is all recorded and managed publicly using a technology called the blockchain (more on that anon).

What does ‘fungible’ mean?

First, it’s important to understand the difference between the words ‘fungible’ and ‘non-fungible’ – this helps most people grasp the basics.

Fungible applies to things that can be easily replaced by another of equal value. When you get cash out of an ATM, you don’t read the serial numbers on the paper, you trust that your cash is as good as everyone else’s cash.

Let’s dig into that:

If you give someone a £20 note in exchange for 2x £10 notes you still have £20.

In the digital economy Bitcoin is fungible in exactly the same way. Still with us? Great.

Okay, but what about ‘non-fungible’?

Non-Fungible items, however, can be classed as unique and special – they’re not easily replaced.

We live in a non-fungible world.

What’s this got to do with digital collectibles?

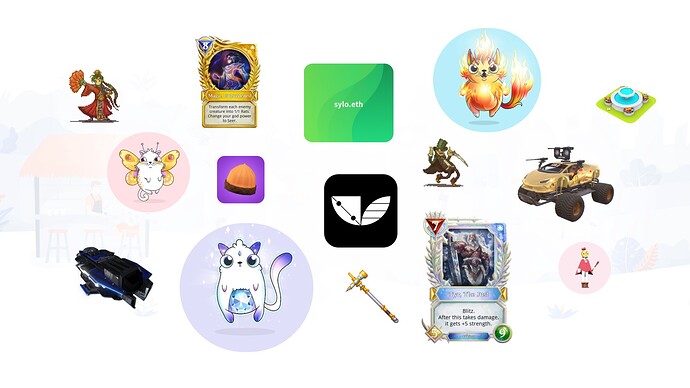

So, that’s non-fungible sorted, but where does the word ‘token’ come into play? This is where the aforementioned blockchain becomes a game-changer, quite literally. In our industry, non-fungible digital items are already commonplace – people have spent small fortunes on micropayments in games like Fortnite to buy limited edition swag and weaponry.

While those items are non-fungible, they can’t be used outside the game or sold on to others. In short, despite paying for the items, the player never owns them in any real sense – at least not outside of the game itself. The game’s publisher has full control over the asset and its distribution at all times.

The blockchain, however, allows developers to add an extra layer to their in-game digital assets that effectively hands ownership and management permission to the end-user. This process is known as ‘tokenization’ and turns the item into an NFT (using the ERC-721 standard, which we cover in more detail here), at which point developers can also bestow unique information that makes the object extremely rare and desirable, like a limited-edition or one-of-a-kind weapon.

In the context of games, NFTs give players real ownership over their items, allowing them to monetize the rare assets they earn or buy in-game on open marketplaces. You see this in action in our own game Reality Clash; or in the likes of CryptoKitties. But NFTs can equally be used in non-game environments, such as for digital NBA and NFL trading cards, real-world property or works of art.

Pretty cool, huh?