The world is constantly evolving and it is no different for the crypto ecosystem, since the emergence of blockchain technology in the Bitcoin project, advances have moved at a giant steps.

But in order to explain the novelties that have been emerging and are increasingly on everyone’s lips, such as DeFi, DApps and collectible tokens or NTFs, it is appropriate to understand what we mean by a centralized network system and a decentralized one.

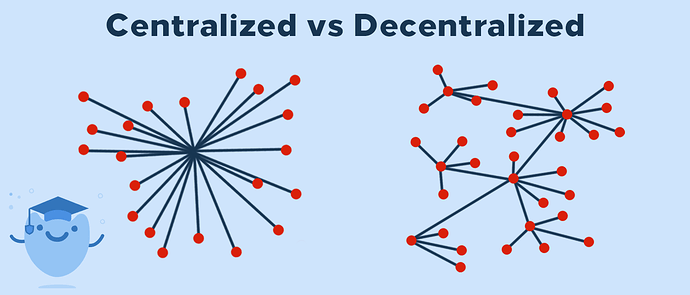

Centralized network vs decentralized network

A centralized network, as its name implies, focuses all its activity on a single point, where authority and decision-making at that point corresponds to a single group of people, unlike this type of network systems, in a decentralized network system activity is never concentrated in a single point, so authority is based on all users belonging to that network.

To understand a little better, in the following image you can see an example of how a centralized system is constituted compared to a decentralized one.

What are the benefits of a decentralized network?

-

Easy globalization

-

Transparency

-

Equity

-

Resistance to censorship

-

Autonomy

Decentralized Finance or better known as DeFi, is an emerging decentralized financial system in the crypto ecosystem that is constantly growing, now also available in the recent Binance Smart Chain (BSC) network.

What benefits does DeFi bring to the crypto ecosystem?

DeFi as a decentralized finance system, offers users full control of their economic assets and opens the possibility of being able to emulate use cases of the traditional centralized economic system, such as loans, currency exchange, interest earnings, all this automated way and without intermediaries that regulate the activity.

The value that DeFi brings to the ecosystem means that now the power to manage the flow and supply of currencies, stocks, bonds and interests may no longer be based on a handful of centralized institutions which dictate who has access to these financial services and who doesn’t, bringing with them a non-inclusive and potentially corrupt system.

If you want to learn how to use DeFi, then I attach a post where it explains How you can use DeFi with Trust Wallet

Decentralization is here to stay in APPs too

The effort to create new uses from blockchain technology surprises, and that you briefly met DeFi, a decentralized economic system. It is time to introduce you to the decentralized side of APPs, another wonderful project.

What are DApps?

DApp or decentralized application is an interface that allows us to interact from our mobile device with a smart contract that belongs to a blockchain network.

Compared to a common APP, a DApp has as a backend (part of a web or application in charge of all the code and functional logic) a smart contract and instead of a database (where absolutely all the processed data is stored by the app or web, including those of the user) a blockchain network.

Benefits of DApps

By belonging to a blockchain network, it implies that they enjoy the benefits of a decentralized network, some of these are:

-

They are open source, so they have a high degree of transparency, any user can access the code, extract it, modify it, copy it or emulate it.

-

They run on a blockchain network, which makes them independent from central servers or third parties to function, also guaranteeing your privacy and avoiding centralization.

-

Constant availability, since they operate on a blockchain network, there is no server outage that causes downtime.

-

They have cryptographic security, this implies that they have a dense layer of security which prevents possible failures or hacking attempts.

The TrustWallet wallet has its own browser compatible with DApps, below, I attach a link where it is explained in detail How to use the DApp browser on IOS

Here is a short list of some popular DApps that are frequently used from TrustWallet:

-

PancakeSwap: a fully automated token exchange marketplace based on the Binance BSC network.

-

Aave: An open source, non-custodial protocol created to earn interest on deposits and loans.

-

LORDLESS: A fantasy game in which you rule your own tavern, do missions and get rewards.

Crypto collectibles or non-fungible tokens (NFTs)

Blockchain technology has made programmable digital scarcity possible, even at a level where Bitcoin is considered by many to be digital gold. It was a matter of time to find a way to adapt this to real world cases, thus giving rise to non-fungible tokens or NFTs.

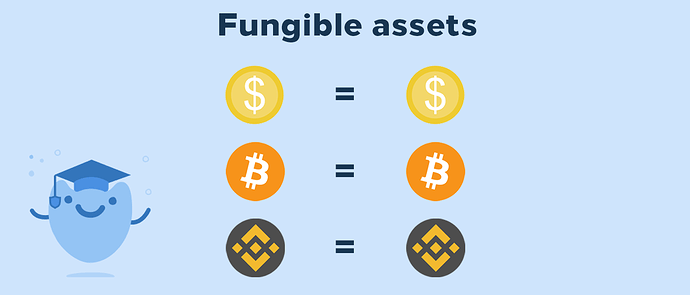

Before, to get into the topic of NFTs, we must know what we mean by fungible, fungibility means that the units belonging to an asset are interchangeable for any other unit of the same asset.

A practical example is the dollar, each unit of the dollar is interchangeable for another unit of the dollar in its equivalent.

You can lend a friend $100 USD and he can pay you later with 5 bills of $20 USD, at the end of the day the amount he paid you is the same as the one you lent him despite returning it to you in different units of the same asset, which makes it a fungible asset.

For the NFTs this does not apply, since they are unique assets in their code within the blockchain so they cannot be repeated or are limited in their existence, preventing one from replacing another.

This opens up possibilities such as exclusive works of art, exotic objects, items from a video game, among others. All digitally and backed by the security of cryptography.

Trust Wallet allows you to store your collectibles safely, in case you want to expand the information I invite you to access its collectibles section.

Conclusion

The crypto ecosystem is advancing exponentially and it is becoming easier to maximize our capital in cryptocurrencies through systems such as DeFi, DApps or NFTs, always with the benefits of decentralization.I hope this article has been useful to expand your knowledge.