Trading on Trust Wallet

There are risks associated with trading cryptocurrencies due to volatility. The prices are speculative, and it is important that you understand how crypto works before you start trading. Unexpected changes in market sentiment can lead to sharp and sudden price moves.

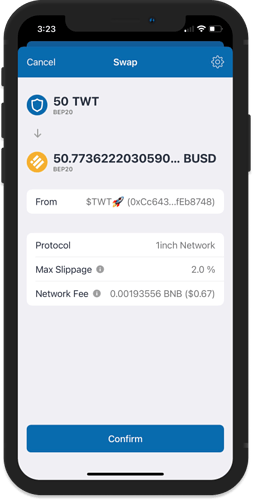

Trust Wallet has a built-in DEX agreggator that connects to the 1Inch Network to trade ETH < > ERC20 tokens, as well as Smart Chain BNB < > BEP20 tokens. Binance DEX is also integrated that allows the exchange of Binance Chain BNB < > BEP2 tokens. Trust Wallet does not control these markets, users are just provided a way to interact with these decentralized exchanges.

Keep in mind that each trade will require a transaction fee. In the case of DEX trading, you need to have some BNB or ETH. The most important thing is the liquidity of the token you are trying to buy or sell. If there isn’t much liquidity that means there are not many buy or sell orders, which can cause the market to move easily. If you make a big market trade in an illiquid market you could lose money due to slippage.

Further information about the DEX can be found here. If you just want to go ahead and start trading then we have a guide that you can follow.

Here are some of the risks that every DEX trader has to be aware of:

Trading Fees

Trading on the app will always incur fees and all of these goes to the miners or validators of the network. Failed transactions are uncontrollable, as there is always a possibility of a sudden change in the volume or price of a token. This will cause the transaction to get rejected by the network and fees are still taken afterward. Once the ETH network gets congested there will be an increase of network fees.

The app will always find the best transaction fees whenever possible. Just be mindful of the trades you are doing, as this is your sole responsibility. Once a trade is confirmed on the network, it cannot be reversed.

SmartChain BNB network fee

Slippage

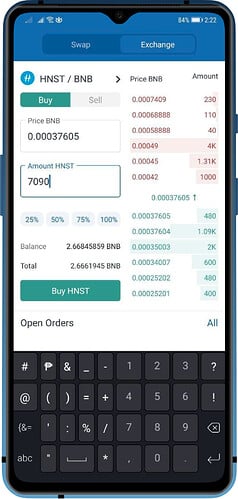

The liquidity of a token you are trying to buy or sell depends on the active limit orders placed on the exchange. A limit order is determined by you and by anyone who places an order on the exchange. These limit orders are shown on an exchange in the order book. When a limit order is set, the trade will only be executed if the market price reaches your limit price (or better). This is similar to when you place an order on the Exchange tab of the DEX.

Here is an example:

A manual order is created to buy some HNST tokens.

You determine the price and amount you are buying.

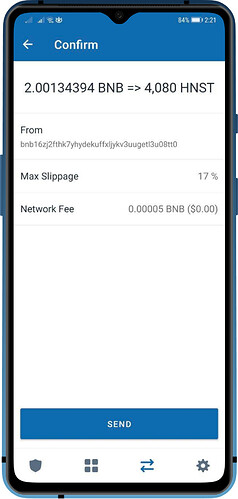

However, if you try to buy the same token on the Swap option of the DEX. You will notice that you will get less tokens for the same amount of BNB.

This is what we call a market order. Market orders will force the trade regardless of the token price. It is advisable only to do a market order if there is high liquidity. The example above will result in massive slippage - almost 17%.

The reason why there is slippage for this trade is that the cheapest limit sell order available is not sufficient to fill the entire market buy order, so your order will automatically match the following limit sell orders, working its way up the order book until it is completed.

Price

This is the most unpredictable aspect when doing trades as the market is purely speculative. We will never know if the price of the token will rise or fall. You must be prepared to react to these changes in price as the app cannot manage it for you. The app can only do crypto to crypto transactions and it cannot convert your crypto to fiat.